PUBLIC NOTICE – REGISTERED PRACTICING ACCOUNTANTS

Right to Practice Accountancy:

Pursuant to Section 4 of the Accountants Act 2010, no person shall undertake the practice in accountancy in Solomon Islands unless that person is registered under this Act under the relevant category of registered persons.

Illegal Practice:

Pursuant to Section 6 of the Act, a person, other than a registered practicing accountant, commits an offence if the person –

(a) falsely represents him or herself as a registered practicing accountant;

(b) assumes or uses the name or title of a registered practicing accountant, or any other name, title, addition or description implying that he or she is a registered practicing accountant; (c) practises as a registered practicing accountant or charges or receives a fee for work done as a registered practicing accountant; or

(d) undertakes, pretends to undertake, or holds him or herself out as being qualified to undertake, at a fee, any work relating to the making up of accounts or relating to compiling or maintaining books of accounts or relating to the management of a liquidation.

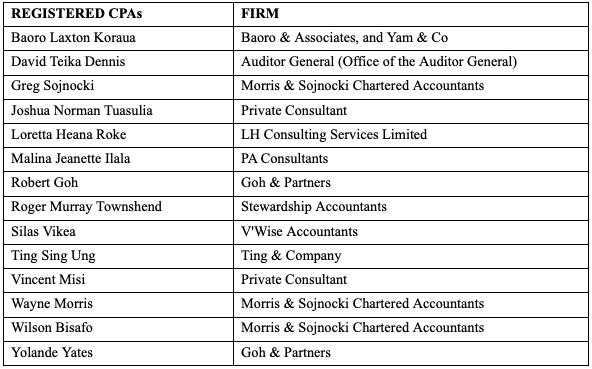

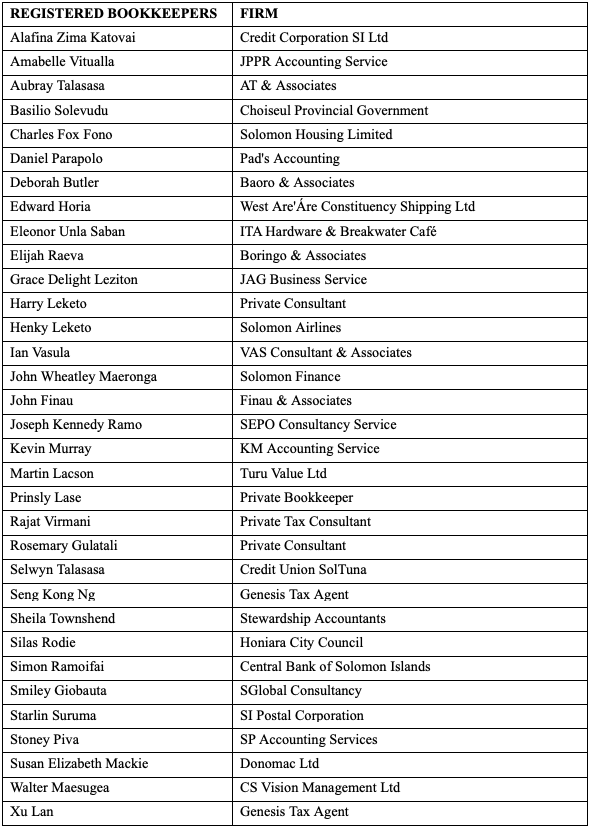

As of 30th June 2024, ONLY the following persons are lawfully determined as Registered Persons under the respective categories of Registered Certified Practicing Accountants (RCPAs), and Registered Book-keepers with the Institute of Solomon Islands Accountants (ISIA).

Any individual or organization engaging persons who are NOT registered with the Institute are doing so unlawfully and at your own risk.

For any enquiries pertaining to this notice, please contact the ISIA Secretariat as follows:

Telephone 677 20131

Email This email address is being protected from spambots. You need JavaScript enabled to view it.